Welcome to Crisis Credit Solutions

INVEST IN YOUR CREDIT.

INVEST IN YOUR FUTURE.

Join our FREE community with those who are working to achieve their dream life!

Join our FREE community with those who are working to achieve their dream life!

Our program has helped people just like you increase their credit score FAST.

Find out if you qualify in 60 seconds with our quick and easy process!

OUR PROGRAM PROVIDES YOU WITH:

The credit FACTS to increase your credit score the RIGHT way...

Little-known hacks to SAVE you money!

Financial literacy that we're not taught in school.

A game-plan to eliminate ALL the negative remarks legally!

SO YOU CAN...

Buy or Refinance Your Home

Purchase a New Vehicle

Qualify for a Better Job

Move into a Better Apartment

Reduce Stress in Your Relationship

Get Approved for Credit Cards (At low rates)

Save Thousands of Dollars a Year

Lower Insurance payments

Lower Car Payments

The BEST Interest rates

HOW WE IMPROVE YOUR LIFE

Crisis Credit Solutions isn't just another credit repair company. Repairing your credit is half the work, knowing how to maintain and build better credit over time, is the most important part. We provide everything you need to set yourself up for a lifetime of good credit.

Repair Your Credit

We challenge every piece of negative information every month. This makes your repair process much shorter, saving you money.

Rebuild Your Credit

We help you open specifically-selected, preapproved lines of credit to add positive information to your report, making it easier to get more approvals later.

Educate!

We you every step of the way on how to build and maintain your credit scores!

YOUR EXCELLENT CREDIT SCORE STARTS HERE

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250 Enrollment Fee

$169 monthly

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

Singles Plan

$150 Enrollment Fee

$99 Monthly

+tax

Credit Education

3 Bureau Credit Audit

24/7 Client Portal Access

Credit Building

Customer Service Support

No Contract

Monthly Updates

Unlimited Disputes

Couples Plan

$220 Enrollment Fee

$160 Monthly

+tax

Credit Education

3 Bureau Credit Audit

24/7 Client Portal Access

Credit Building

Customer Service Support

No Contract

Monthly Updates

Unlimited Disputes

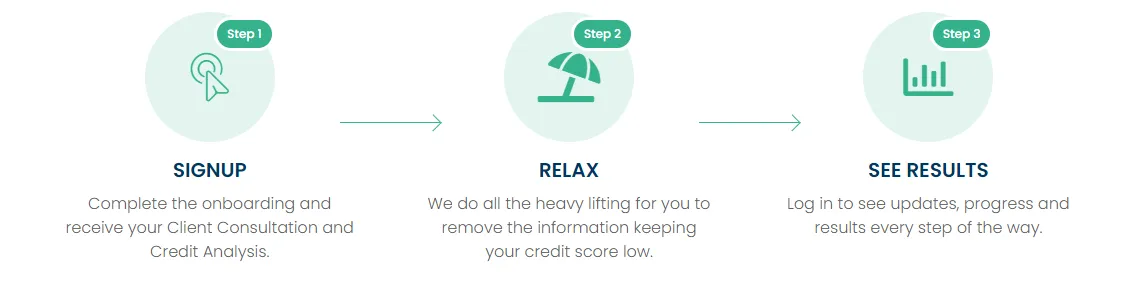

Getting Started Is As Easy As 1-2-3

Free Resources For Financial Freedom

RESOURCES

Credit From The Ground Up

Learn how to build strong credit from scratch, step by step.

Credit Score Cheat Sheet

Understand what impacts your score and how to raise it fast.

Homebuyers Prep Guide

Get mortgage-ready with this step-by-step guide to buying your first home.

101 Credit Tips

Boost your score fast with these powerful strategies.

LATEST ARTICLES

The Importance of Having a Budget | Road to Financial Stability

“Used correctly, a budget doesn't restrict you; it empowers you.” - Tere Stouffer

Budgeting is an essential life skill that is crucial for everyone, yet it's left out of the educational system. In my view, integrating credit and financial education into the school curriculum could greatly shift this issue.

Personally, I never received education or guidance on financial literacy, which led me into several challenging situations due to my lack of money management. When I decided to take control of my finances, the first step I took was setting up a budget.

Having a budget caused a tremendous change in our financial life! We finally started saving and paying down debt.

There have also been numerous moments in my life when things got hectic – between work, kids, school, cooking dinner, and everything else – and I let my budget slip. Have you ever found yourself just "winging it"? That was definitely me! In the hustle and bustle of daily responsibilities, I'd often forget to pay a bill on time or end up paying only the bare minimum because I wasn't adequately prepared.

It's safe to say not staying on top of our budget - caused a negative affect on things.

I don't think you came across this blog by accident. I think you're aware that you need a budget! Check out 6 reasons why you need a budget. If you need help building or reviewing your budget, let's work together to fix that!

6 Reasons Why You Need A Budget

1. Financial Awareness

Creating a budget forces you to take a closer look at your financial situation. You'll gain a clear understanding of where your money comes from and where it goes. This awareness helps in making informed financial decisions, avoiding unnecessary expenses, and prioritizing spending on what truly matters.

2. Control Over Finances

Budgeting puts you in control of your money, rather than letting money control you. By tracking your expenses, you can spot areas where you may be overspending and make adjustments. This control helps prevent impulse buying and ensures that every dollar is spent purposefully.

3. Achieving Financial Goals

Whether you’re saving for a down payment on a house, planning a vacation, or building an emergency fund, a budget is essential for reaching your financial goals. It helps you set aside money regularly for these purposes, making it easier to achieve your aspirations without financial stress.

4. Avoiding Debt

One of the most significant benefits of budgeting is avoiding debt. By planning your expenses and living within your means, you can prevent overspending and the need to borrow money. This proactive approach can save you from high-interest debt and financial troubles in the future.

5. Preparedness for Emergencies

Life is unpredictable, and unexpected expenses can arise at any time. Having a budget allows you to allocate funds for an emergency savings account. This preparedness ensures that you have a financial cushion to fall back on in case of medical emergencies, car repairs, or sudden job loss.

6. Promotes Discipline and Responsibility

Budgeting promotes financial discipline and responsibility. It encourages you to think twice before making purchases and instills a sense of accountability as you track your spending. Over time, this practice can lead to healthier financial habits and long-term financial well-being.

Budgeting is a powerful tool that can transform your financial life. It provides clarity, control, and confidence in managing your money, helping you achieve your goals and prepare for the future. By embracing budgeting, you can take charge of your finances and build a secure and prosperous future.

Remember, a budget is not a restriction but a pathway to financial freedom. Start today, and take the first step towards a more structured and fulfilling financial journey!

If you're ready to work towards financial success, check out our online store.

Convinced you need a budget now? Schedule a free consultation and we can discuss next steps for preparing a budget plan!

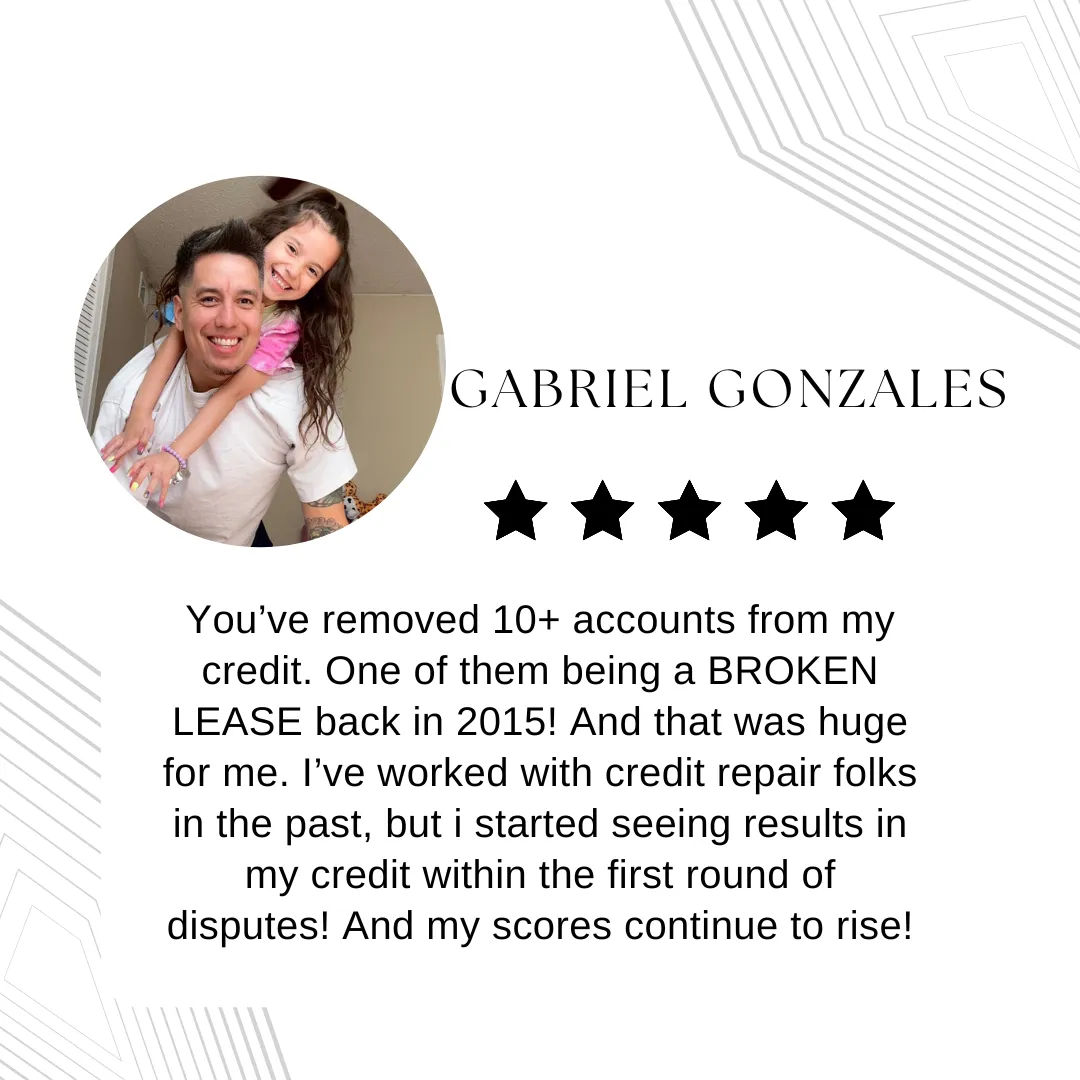

Testimonials

HAPPY CLIENTS

About Us

A professional credit restoration company based in Victoria, Texas that is driven to help consumers repair and rebuild their credit file to achieve credit worthiness.

Copyright 2022 Crisis Credit Solutions

Copyright 2022 Crisis Credit Solutions