Welcome to Crisis Credit Solutions

INVEST IN YOUR CREDIT.

INVEST IN YOUR FUTURE.

Join our FREE community with those who are working to achieve their dream life!

Join our FREE community with those who are working to achieve their dream life!

Our program has helped people just like you increase their credit score FAST.

Find out if you qualify in 60 seconds with our quick and easy process!

OUR PROGRAM PROVIDES YOU WITH:

The credit FACTS to increase your credit score the RIGHT way...

Little-known hacks to SAVE you money!

Financial literacy that we're not taught in school.

A game-plan to eliminate ALL the negative remarks legally!

SO YOU CAN...

Buy or Refinance Your Home

Purchase a New Vehicle

Qualify for a Better Job

Move into a Better Apartment

Reduce Stress in Your Relationship

Get Approved for Credit Cards (At low rates)

Save Thousands of Dollars a Year

Lower Insurance payments

Lower Car Payments

The BEST Interest rates

HOW WE IMPROVE YOUR LIFE

Crisis Credit Solutions isn't just another credit repair company. Repairing your credit is half the work, knowing how to maintain and build better credit over time, is the most important part. We provide everything you need to set yourself up for a lifetime of good credit.

Repair Your Credit

We challenge every piece of negative information every month. This makes your repair process much shorter, saving you money.

Rebuild Your Credit

We help you open specifically-selected, preapproved lines of credit to add positive information to your report, making it easier to get more approvals later.

Educate!

We you every step of the way on how to build and maintain your credit scores!

YOUR EXCELLENT CREDIT SCORE STARTS HERE

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250 Enrollment Fee

$169 monthly

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

Singles Plan

$150 Enrollment Fee

$99 Monthly

+tax

Credit Education

3 Bureau Credit Audit

24/7 Client Portal Access

Credit Building

Customer Service Support

No Contract

Monthly Updates

Unlimited Disputes

Couples Plan

$220 Enrollment Fee

$160 Monthly

+tax

Credit Education

3 Bureau Credit Audit

24/7 Client Portal Access

Credit Building

Customer Service Support

No Contract

Monthly Updates

Unlimited Disputes

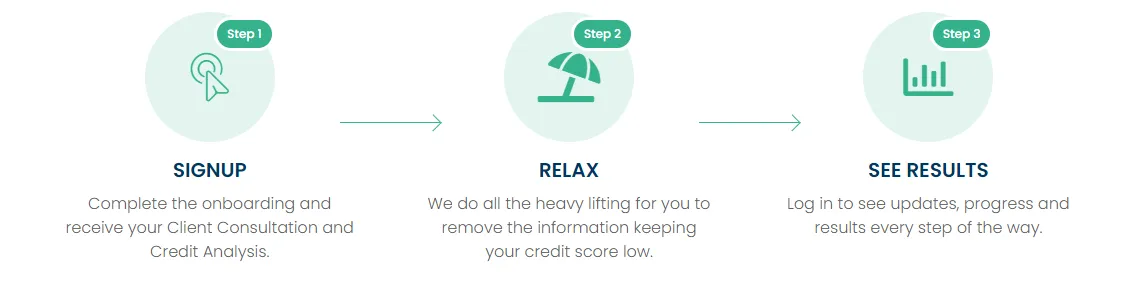

Getting Started Is As Easy As 1-2-3

Free Resources For Financial Freedom

RESOURCES

Credit From The Ground Up

Learn how to build strong credit from scratch, step by step.

Credit Score Cheat Sheet

Understand what impacts your score and how to raise it fast.

Homebuyers Prep Guide

Get mortgage-ready with this step-by-step guide to buying your first home.

101 Credit Tips

Boost your score fast with these powerful strategies.

LATEST ARTICLES

Top Tips for Financial Success | Achieve Financial Freedom Today

“Financial Freedom is available to those who learn about it and work for it.” - Robert Kiyosaki

Achieving financial success is something that many people want to reach.

It makes sense as money can greatly determine how a person lives their life.

Money can even be a factor in your happiness. I’m not saying that money equals happiness, but if you’re stressed about money, you may feel depressed, inadequate, or have other negative feelings.

I completely understand that there are some situations where things are outside of your control, leading to a lot of financial stress and awful feelings.

It can be incredibly difficult to overcome situations like that.

Still, I truly believe that there are things you can do to become more financially secure and reach financial freedom. Everyone’s path will be different, but I believe it’s possible.

So, what is financial freedom and financial success? And, how do you become financially successful?

Financial success means something different to everyone.

It could mean that you no longer have debt, that you no longer have stress from money, money no longer controls you, you have paid off your house, you’ve reached retirement, or something else.

It can be one or all of those things. There are no rules to what financial success is because everyone has unique and different circumstances.

For example, if you were finally able to pay off a medical bill, that can be financial success for you.

Feeling financially free is when you are able to live life without worrying about money. It’s when you feel comfortable enough to follow your passion, instead of thinking about the income you are bringing in.

It allows you to stop stressing about unexpected expenses because you have an emergency fund. It’s when you live without money controlling your life.

Financial freedom and success aren’t all about the amount of money you earn. It can be about how much money you are able to save, your money habits, and more.

Today’s post is going to help you gain control of your money and learn how to reach financial success, no matter what it means to you. These are all tips I use in my personal life, and they’ve helped me gain control of my money and stress about it less.

Here are 9 tips for financial success.

1. Create a Budget and Stick to It

One of the fundamental steps toward financial success is creating a budget. A budget helps you track your income and expenses, ensuring that you live within your means. Here's how you can create an effective budget:

List all sources of income: Include your salary, freelance work, or any other sources of income.

Track your expenses: Categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out).

Set spending limits: Allocate your income toward essentials first, then discretionary spending, and finally, savings.

2. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can provide a financial cushion for unexpected expenses like medical emergencies, car repairs, or sudden job loss. Aim to save at least three to six months' worth of living expenses.

3. Invest in Your Future

Investing is a powerful tool for building wealth over time. Start by contributing to retirement accounts like a 401(k) or IRA. Diversify your investments to include stocks, bonds, and real estate. Remember, the earlier you start investing, the more time your money has to grow.

4. Pay off your high-interest rate debt

If you have any high-interest rate debt, such as credit card debt, then I highly recommend paying it off quickly.

High-interest rate debt simply becomes more and more difficult to pay off over time as those interest charges build and build and become unmanageable. Before you know it, that $100 you spent at the store may be costing you $500 over the years.

This kind of debt can add a crazy amount of stress, and it becomes increasingly hard to pay off. And, it will most likely prevent you from reaching your other financial goals.

Due to this, I recommend making a plan and starting to pay off your high-interest rate debt as soon as you can.

To start, take a look at why you are in debt in the first place as this will help you move forward and not fall into the same mistake later in the future.

Then, the next step is to attack your debt!

Figure out what you can do to eliminate it, which will most likely include finding ways to make extra money, cutting your expenses, making extra debt payments, and so on.

5. Improve Your Financial Literacy

Knowledge is power when it comes to managing your finances. Invest time in learning about personal finance. Read books, listen to podcasts, take online courses, and consult with financial advisors to expand your understanding.

6. Set Financial Goals

Having clear, achievable financial goals can keep you motivated and focused. Whether it's saving for a down payment on a house, starting a business, or planning a dream vacation, setting specific goals gives you a target to work toward.

7. Live Below Your Means

Living below your means doesn't mean depriving yourself but being mindful of your spending. Prioritize essential expenses, avoid lifestyle inflation, and seek out cost-effective alternatives without compromising your quality of life.

8. Automate Savings

Automating your savings can make the process effortless. Set up automatic transfers to your savings or investment accounts to ensure you're consistently saving a portion of your income.

9. Review and Adjust Your Financial Plan Regularly

Your financial situation and goals will change over time. Regularly review your financial plan and make adjustments as needed to stay on track. This practice will help you adapt to life changes and ensure you're making progress toward your financial goals.

Embarking on the journey to financial success requires discipline, knowledge, and consistent effort. By adopting these tips, you can lay a solid foundation for a prosperous financial future. Remember that every small step counts toward achieving financial stability and freedom. Start today and pave the way for a brighter tomorrow!

If you're ready to work towards financial success, check out our Wealth Wellness Bundle:

This bundle is jam packed with Goal Settings, monthly budget, expense trackers, no spend challenge, financial literacy, and MORE.

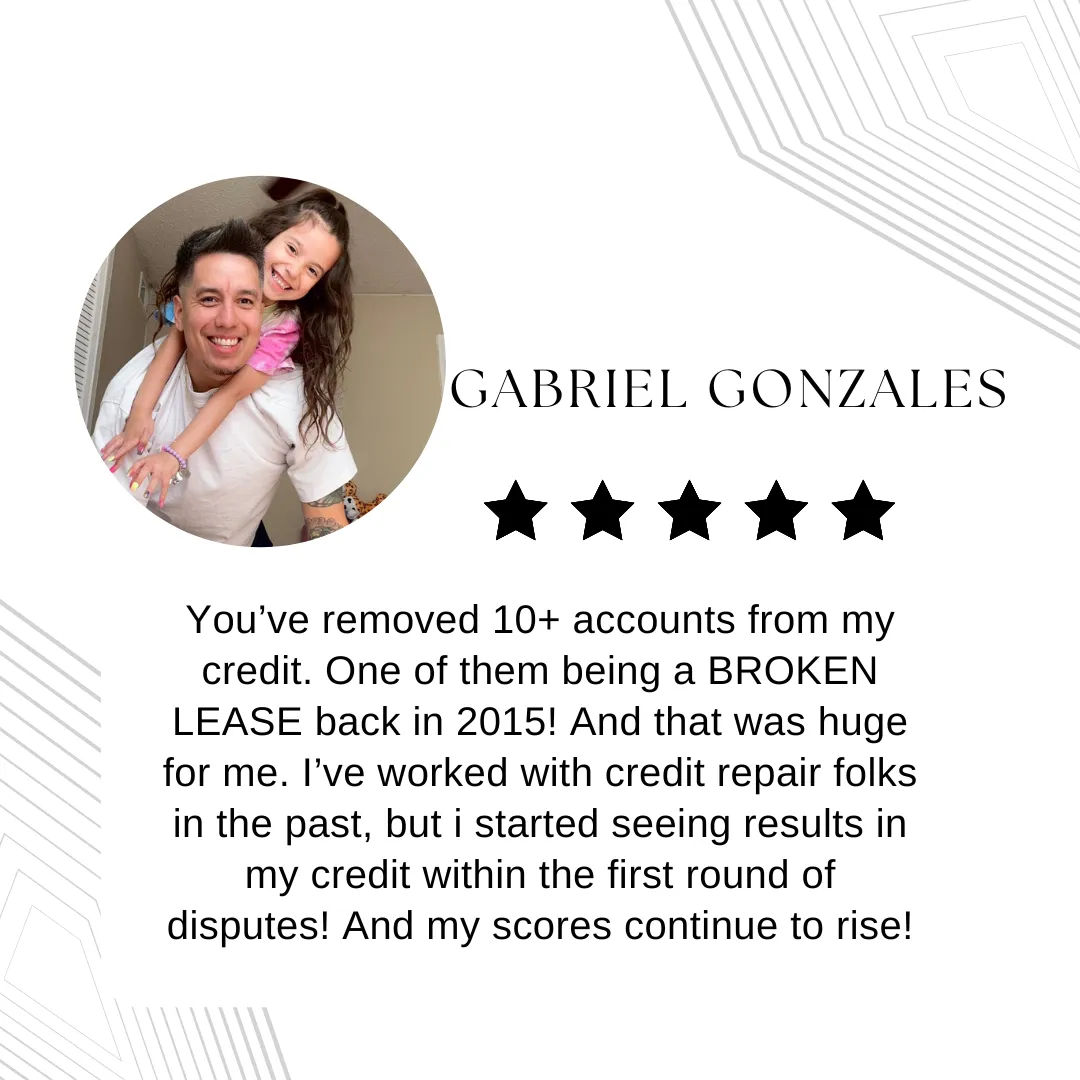

Testimonials

HAPPY CLIENTS

About Us

A professional credit restoration company based in Victoria, Texas that is driven to help consumers repair and rebuild their credit file to achieve credit worthiness.

Copyright 2022 Crisis Credit Solutions

Copyright 2022 Crisis Credit Solutions