Welcome to Crisis Credit Solutions

INVEST IN YOUR CREDIT.

INVEST IN YOUR FUTURE.

Join our FREE community with those who are working to achieve their dream life!

Join our FREE community with those who are working to achieve their dream life!

Our program has helped people just like you increase their credit score FAST.

Find out if you qualify in 60 seconds with our quick and easy process!

OUR PROGRAM PROVIDES YOU WITH:

The credit FACTS to increase your credit score the RIGHT way...

Little-known hacks to SAVE you money!

Financial literacy that we're not taught in school.

A game-plan to eliminate ALL the negative remarks legally!

SO YOU CAN...

Buy or Refinance Your Home

Purchase a New Vehicle

Qualify for a Better Job

Move into a Better Apartment

Reduce Stress in Your Relationship

Get Approved for Credit Cards (At low rates)

Save Thousands of Dollars a Year

Lower Insurance payments

Lower Car Payments

The BEST Interest rates

HOW WE IMPROVE YOUR LIFE

Crisis Credit Solutions isn't just another credit repair company. Repairing your credit is half the work, knowing how to maintain and build better credit over time, is the most important part. We provide everything you need to set yourself up for a lifetime of good credit.

Repair Your Credit

We challenge every piece of negative information every month. This makes your repair process much shorter, saving you money.

Rebuild Your Credit

We help you open specifically-selected, preapproved lines of credit to add positive information to your report, making it easier to get more approvals later.

Educate!

We you every step of the way on how to build and maintain your credit scores!

YOUR EXCELLENT CREDIT SCORE STARTS HERE

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250 Enrollment Fee

$169 monthly

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

Singles Plan

$150 Enrollment Fee

$99 Monthly

+tax

Credit Education

3 Bureau Credit Audit

24/7 Client Portal Access

Credit Building

Customer Service Support

No Contract

Monthly Updates

Unlimited Disputes

Couples Plan

$220 Enrollment Fee

$160 Monthly

+tax

Credit Education

3 Bureau Credit Audit

24/7 Client Portal Access

Credit Building

Customer Service Support

No Contract

Monthly Updates

Unlimited Disputes

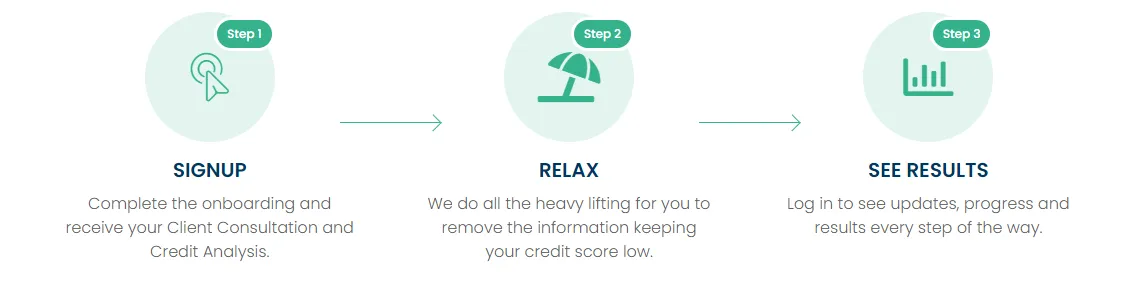

Getting Started Is As Easy As 1-2-3

Free Resources For Financial Freedom

RESOURCES

Credit From The Ground Up

Learn how to build strong credit from scratch, step by step.

Credit Score Cheat Sheet

Understand what impacts your score and how to raise it fast.

Homebuyers Prep Guide

Get mortgage-ready with this step-by-step guide to buying your first home.

101 Credit Tips

Boost your score fast with these powerful strategies.

LATEST ARTICLES

How to Use Credit Cards Wisely to Rebuild Your Credit

Let’s be real — credit cards often get a bad rap. Some people even consider them evil, especially after racking up large balances and paying outrageous interest. But truthfully, it's not the card — it's how it's used.

For the most part, it’s the irresponsible use of credit cards that leads to financial trouble.

Using a credit card responsibly requires discipline. And if that’s something you know you’re still working on, it may be better to stick to using a debit card for now.

Before we dive into the smart ways to use credit cards to rebuild your credit, let’s take a step back and cover the basics.

How Do Credit Cards Work?

A credit card allows you to borrow money from a financial institution up to a certain limit to pay for goods or services. If you don’t pay off the balance in full each month, you’ll be charged interest — sometimes at pretty high rates.

That’s why they can either be helpful or harmful depending on how you manage them.

Benefits of Using Credit Cards Responsibly

Build credit history — Showing you can borrow and repay builds trust with lenders.

Earn rewards — Many cards offer cashback, points, or travel perks.

Emergency backup — If used carefully, a card can help during unexpected expenses.

Purchase protection — Many cards offer fraud protection and dispute resolution.

How to Use Credit Cards Wisely to Rebuild Your Credit

Now that you understand the “why,” here are the practical “how-to” steps to make credit cards work for you — not against you:

1. Always Make On-Time Payments

Payment history is the #1 factor in your credit score. Set up auto-pay or reminders so you never miss a due date. Even one late payment can do some real damage to your score.

2. Keep Your Balances Low

Try to use less than 30% of your available credit — ideally, under 10%. This is known as your credit utilization ratio, and keeping it low shows lenders you manage credit well.

3. Keep Old Accounts Open

Even if you don’t use them much, don’t close your oldest credit cards. They contribute to the average age of your credit history, which positively impacts your score. To avoid closure due to inactivity, put a small recurring bill on it (like your monthly Spotify subscription).

4. Don’t Have an Abundance of Credit Cards

Using credit cards wisely also means not having too many of them.

More cards = more temptation for impulse shopping

Opening several accounts in a short time can lower your score

You’ll thank yourself when you don’t have a dozen cards to cancel in case of a lost wallet

And yes, you might end up asking: “Can I pay a credit card with another credit card?” (spoiler: not a good habit)

Stick to a few solid cards you manage well. Focus on quality over quantity when building your credit profile.

Bonus Tip: Ask for a Credit Limit Increase

If your credit is in good standing and you’ve been making on-time payments, ask for a limit increase. This improves your credit utilization without having to open a new card — just make sure you don’t use the extra limit as an excuse to spend more.

Final Thoughts

Credit cards can either be a weapon or a tool — the difference is how you use them. With discipline, strategy, and consistency, you can absolutely use credit cards to rebuild your credit and unlock better financial opportunities.

If you're looking to improve your credit and gain access to better credit card option, dowload our Free Credit Boosting Guide today. It's packed with tips and strategies to help you build a strong credit profile and make the most of your financial opportunities. Start boosting your credit now and take control of your financial future!

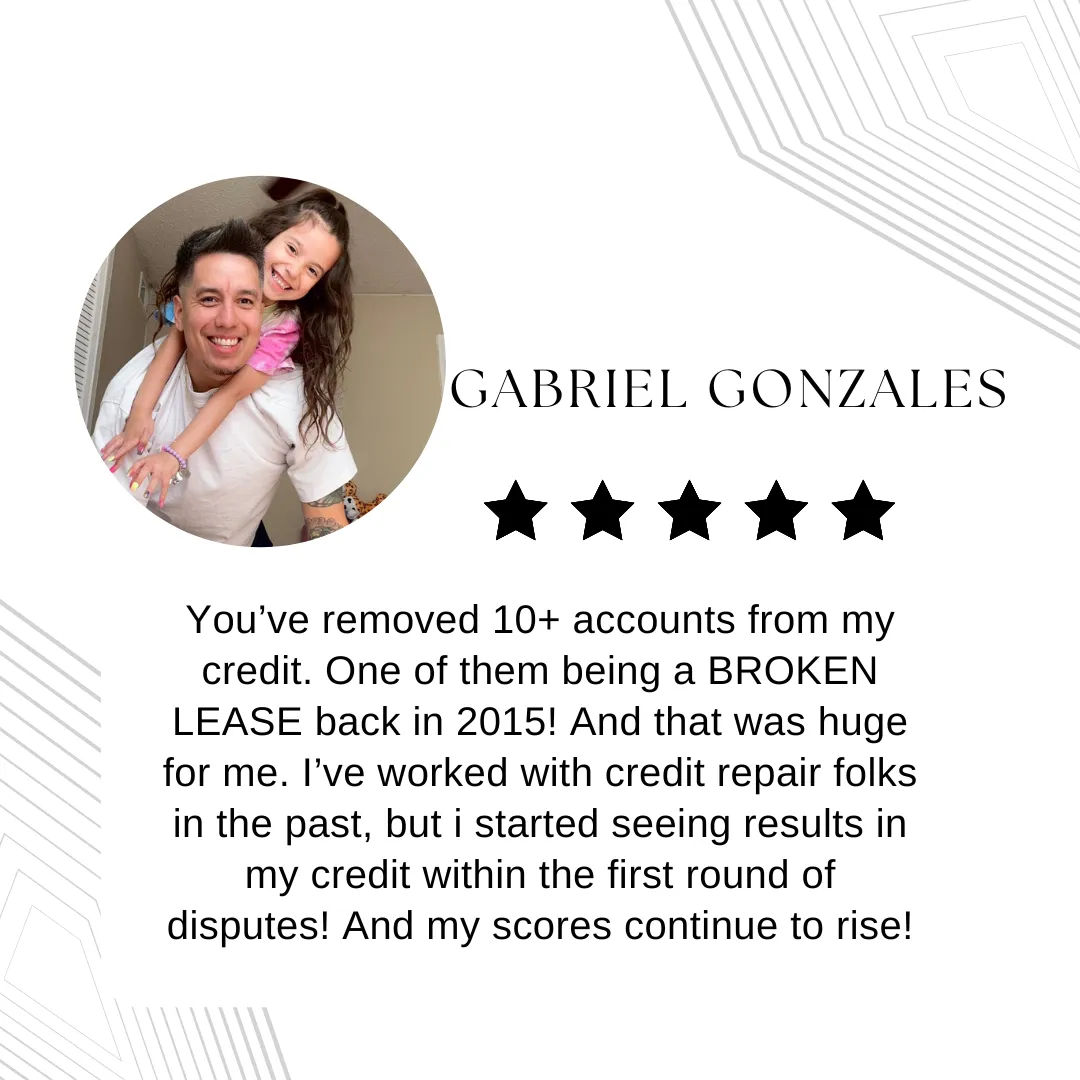

Testimonials

HAPPY CLIENTS

About Us

A professional credit restoration company based in Victoria, Texas that is driven to help consumers repair and rebuild their credit file to achieve credit worthiness.

Copyright 2022 Crisis Credit Solutions

Copyright 2022 Crisis Credit Solutions